Wealth Building is a challenging task that every individual has to plan for and to build that wealth you have to invest your money in some kind of instrument. In this article “Why to invest in Stock Market – Reasons with Benefits and Disadvantages” I will explain the reasons behind investing in the stock market.

It’s pretty much impossible for anyone to predict the moves of the stock market, but amidst the unpredictability, the benefits of investing in stocks remain unchanged. What has changed and should change is the public’s point of view towards investing as they are considering other instruments rather than letting money sit in a savings account.

“The stock market and real estate are the two biggest wealth creators in history”

Sam Seiden, chief education officer at Online Trading Academy

So, to make effective use of idle money consider the below reasons as an elevating factor or motivating factor to invest money in the stock market.

Table of Contents

Reasons:-

Grow your wealth

Investing your money can help you to generate wealth over a long period of time but if you decide to invest in the stock market there is no guarantee how the stocks will behave and what will be their return. However, you can grow your money from 7% – 10 % per year over a long period of time. The CAGR of NIFTY 50 INDEX is about 13% – 14% over a period of 20 years

Imagine that you invested 1,00,000 Rs over a period of 10 years for a return of 10% per annum the amount compounded at the end of tenure would be 2,59,374 Rs that means you have more 1,59,374 Rs that you made with investing.

Imagine that you have invested the same amount for a period of 30 years then the compounded amount at the end of tenure would be 17,44,938 Rs which you can clearly see it is greater than 1,00,000 Rs.

Beating Inflation

The main purpose of the investment is that your money you are investing now should hold value over the end of the tenure, certainly, in this the stock market helps people to achieve a certain rate of return.

While considering the global inflation rate which was about 3 – 4 % in 2019 we can say the things that products that costs us now would rise say over a year.

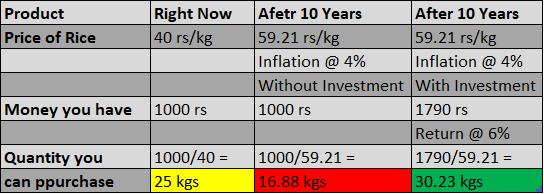

Below is the example of how Inflation has affected the purchasing power over a certain time period and how investing helped to curve it.

From the above image, you can see that purchasing power in present and after 10 years changes widely on if you decide to invest or don’t decide to invest. The example clearly states that investing is a better option to curve inflation.

Unleash Compounding

The most important component of compounding is time and that is possible if the invested time is more for a long period of time. In the above point of Grow Your Wealth, I have explained that if a person stays invested over a period of 30 years then he/she would enjoy a whopping return more than 10 times its invested amount.

HAHA MONEY PRINTER GO BRRRRR….

Stock Market will go up

The stock market has gone up and will go up in the future as it is based on a simple logic that “Consumption never ends in the economy” as simple as it sounds that does wonders for the economy.

For Example, take the example of NIFTY 50 INDEX it has gone up from 1376.00 in 2000 to 9111.00 as of 17 – April – 2020, which is a great rise for an index and most of the major indexes behave almost same.

Not Much Work

You don’t have to do more research while investing in the stock market as compared to establishing or starting a new company on your own. In stock investing for beginners, they can literally choose the company they like or invest in the company which products that they use often.

There is another option that they can directly go on to invest in any INDEX FUND which is well-diversified, of their choice.

Dividend Income

Dividend stocks are blessing to any type of investors out there as these companies give a dividend to their investors on a quarterly and yearly basis and there is a fair advantage of price growth of the stock as well.

Let’s take example of TCS (Tata Communication Services) of TATA Group

| MARCH 2009 | MARCH 2018 | |||

| Share Price | 132 Rs /share | Share Price | 1372 Rs /share | |

| Shares you have | 10 | Shares you have | 20 (1:1 bonus share) | |

| Cost to buy | 1320 Rs | Cost to buy | 1320 Rs | |

| Dividend Paid | 14 Rs /share | Dividend Paid | 50 Rs /share | |

| Dividend Income | 140 Rs | Dividend Income | 1000 Rs |

From the above example, you can see that when you bought 10 shares of TCS in 2009 for 1320 Rs (132 Rs /share), the dividend income for that year was about 14 Rs /share amounting to 140 Rs and till 2018 the share price soar to 1372 Rs and the dividend paid was about 50 Rs /share amounting to 1,000 Rs of dividend.

You can clearly see that investing in the dividend stock is better for a long period of time.

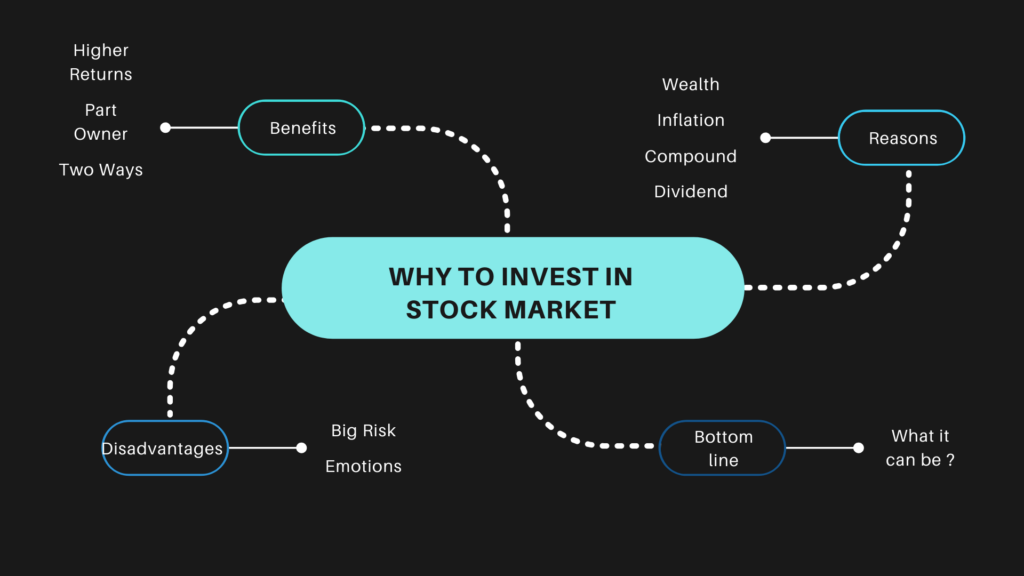

Benefits:

1. There is a probability of getting higher returns after investing in the stock market compared to other types of investments such as PPF (Public Provident Fund) or FD (Fixed Deposit).

2. While buying the stock you become a part-owner of the company its not much but you become a part of it.

3. Money can be made in the stock market in two ways while investing as when buying the stocks of the company you will be able to enjoy the price increment of the stocks as well as the dividend paid by the company.

4. With the development of technology, you can easily buy and sell shares online with less to no paperwork required.

Disadvantages:

1. There is a huge risk while investing in the stock market, as you can lose the whole amount or wealth if the stock does not perform well or you fail to diversify your risk.

2. If you are investing for the first time it’s a big ride for your emotions as the price may fall and rise over the short term but as an investor, you should keep your emotions intact.

Bottom Line

There are many ways to invest in the stock market that can be in the form of micro-level i.e., investing in individual stocks or on the macro-level i.e., investing in indexes that comprises basket of stocks.

I hope this article “Why to invest in Stock Market – Reasons with Benefits and Disadvantages” helped you a lot please share this article with your peers if you found informative and follow me…

Leave a Reply